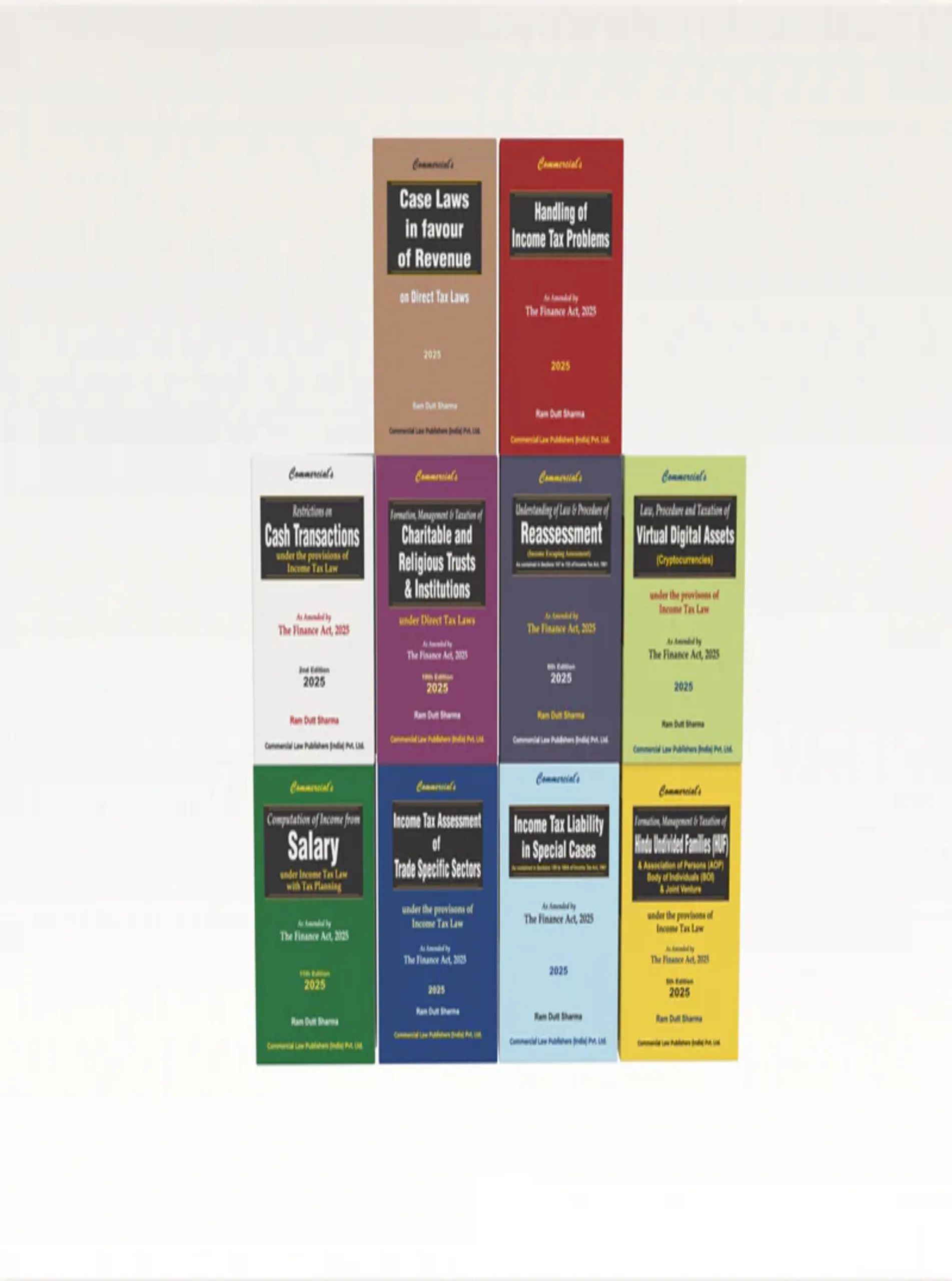

Tax professionals — Combo Pack (10 books)

₹15,400.00 Original price was: ₹15,400.00.₹12,320.00Current price is: ₹12,320.00.

This combo pack offers 10 essential books for tax professionals, covering a wide range of topics in direct and indirect taxation. It includes guidance on income tax, TDS/TCS, tax audits, assessments, appeals, compliance procedures, search and seizure, and international taxation. Designed for professionals, it serves as a comprehensive toolkit for effective tax management and compliance.

In stock

| Authors of Books | Ram Dutt Sharma |

|---|

Must have in your Library

Tax Professionals — Combo Pack (10 Books) is a comprehensive resource set for tax professionals, auditors, chartered accountants, corporate advisors, and students of law and commerce. The set covers all major areas of direct and indirect taxation in India, including income tax, TDS/TCS, tax audit procedures, assessment and appeal processes, search and seizure, penalties, and international taxation principles.

Each book in the pack is practice-oriented, providing clarity on statutory provisions, procedural compliance, legal interpretations, and real-world applications. Readers gain step-by-step guidance for managing tax audits, handling TDS/TCS compliance, navigating assessments and appeals, and mitigating legal risks in revisional or investigational procedures.

With detailed explanations, practical examples, case studies, and references to relevant amendments, this combo pack serves as a professional toolkit for efficient tax management. The collection is particularly beneficial for chartered accountants, tax consultants, corporate finance officers, auditors, law students specializing in taxation, and corporate compliance teams, providing them with a one-stop solution for all taxation matters.

Whether for study, reference, or professional application, this pack ensures that users are well-equipped to handle complex tax issues, remain compliant, and adopt best practices in taxation

| Authors of Books | Ram Dutt Sharma |

|---|

Featured Products

Important Civil Acts covering 15 Acts

🔥 5 items sold in last 7 days

Criminology & Penology

🔥 6 items sold in last 7 days

Interpretation of Statutes

🔥 6 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.