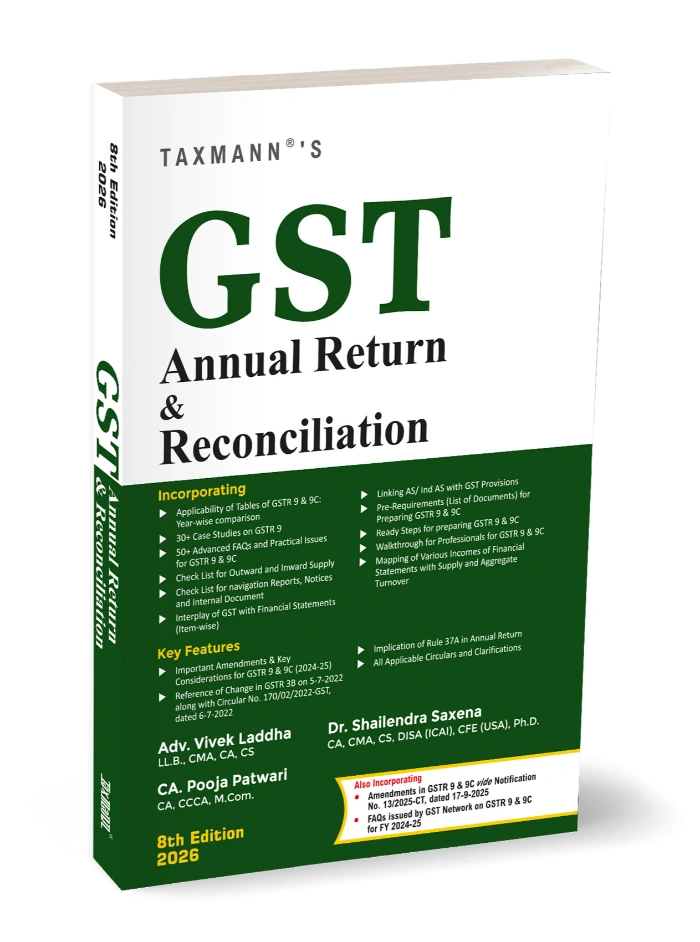

GST Annual Return & Reconciliation 8th Edition 2026

₹1,195.00 Original price was: ₹1,195.00.₹956.00Current price is: ₹956.00.

This book provides a detailed, practitioner-focused guide to filing GST annual returns and reconciling returns under the GST regime. It explains step-by-step procedures for GSTR-9, GSTR-9C, and reconciliation between various GST returns. Updated to the 8th Edition 2025, it equips professionals and businesses to ensure accurate compliance, reduce discrepancies, and streamline audits.

In stock

| Authors of Books | By Vivek Laddha, Shailendra Saxena, Pooja Patwari |

|---|

Must have in your Library

GST Annual Return & Reconciliation – 8th Edition 2026 is an authoritative and practical guide for businesses, accountants, and tax professionals navigating the complexities of GST annual reporting. The book provides step-by-step instructions for filing GSTR-9, GSTR-9C, and reconciliation of GSTR-1, GSTR-3B, and other returns, ensuring all transactions are accurately reflected and discrepancies are identified and resolved. Updated for 8th Edition 2025, the book incorporates recent amendments, clarification notes, and best practices in reconciliation. It highlights common errors, compliance pitfalls, and practical tips to streamline audit preparation. With a clear, structured approach, it simplifies reconciliation, helps avoid notices and penalties, and supports businesses in maintaining clean GST records. The book serves as a complete reference for accountants, GST practitioners, chartered accountants, corporate tax teams, and auditors. By combining theoretical guidance with practical examples, it enables users to confidently manage GST annual returns and ensure full compliance under Indian tax laws.

| Authors of Books | By Vivek Laddha, Shailendra Saxena, Pooja Patwari |

|---|

Featured Products

Important Civil Acts covering 15 Acts

🔥 5 items sold in last 7 days

Criminology & Penology

🔥 6 items sold in last 7 days

Interpretation of Statutes

🔥 6 items sold in last 7 days

By using this website you agree to our Privacy Policy.

Reviews

There are no reviews yet.